Hotel Economics in the Age of COVID-19

Hotel financial performance is directly tied to fundamentals within the property’s local market. Below is a quick snapshot of how hotel fundamentals have been impacted over the past six months due to COVID- 19.

Hotel Demand: Never Have I Ever

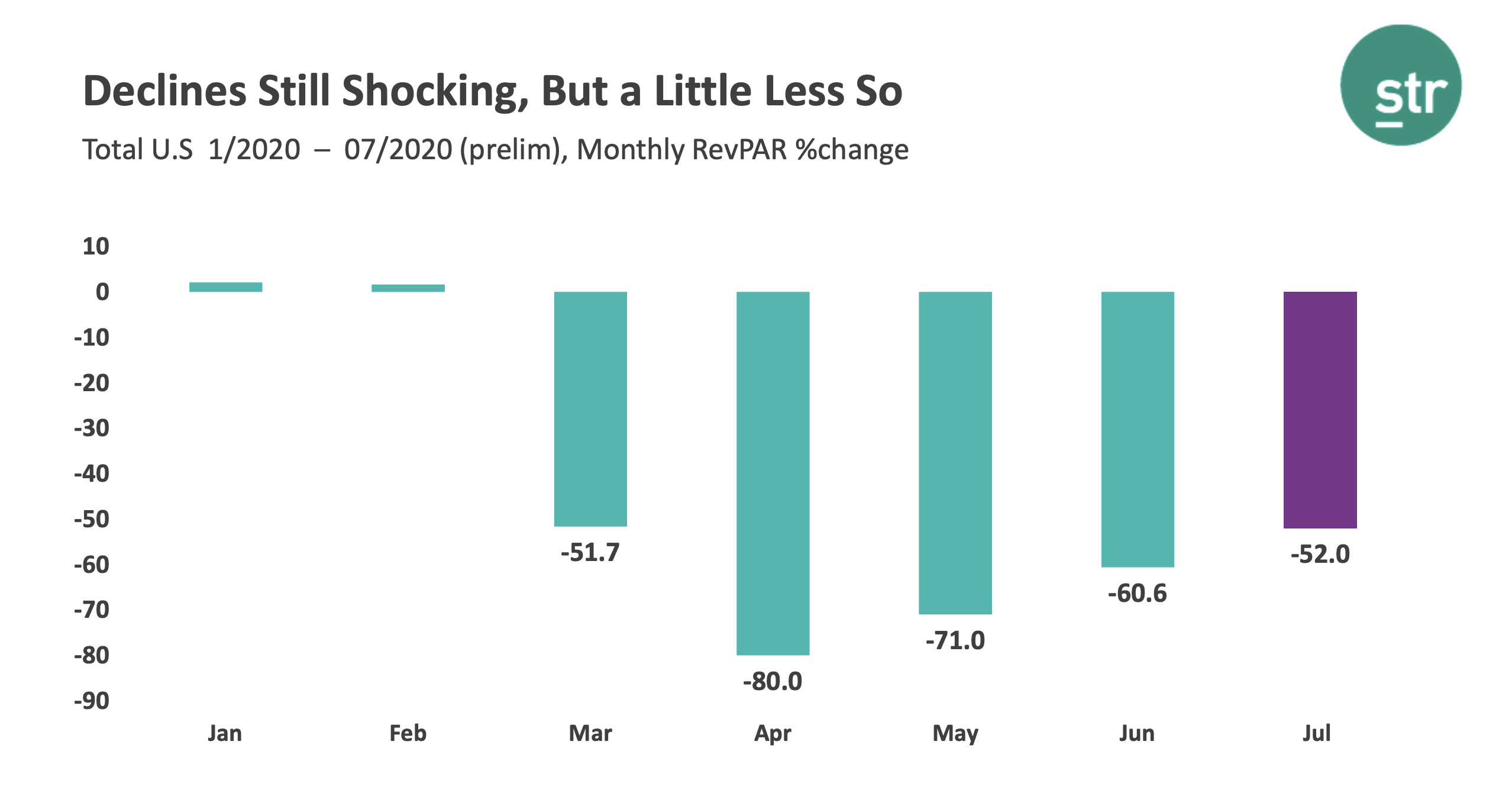

The word “unprecedented” is being used repetitively to describe the post-quarantine world due to COVID. There’s a reason for that. It is one of the only words that can put any perspective around what we are currently experiencing. Overused? Yes. Accurate? 100%. The STR chart below reflects the stomach-dropping RevPar (revenue per available room) decline precipitated by COVID-19. As of April, U.S. RevPar had dropped by 80% at the nadir. As the world has begun to adjust to a “new normal,” we have thankfully seen the numbers begin to crawl out of the basement.

Interestingly, this recovery, if you can call it that, is benefitting leisure driving destinations and the suburbs as people are gravitating towards road trips and less crowded hotels. Core urban hotels that feed off of convention centers and large venues have been impacted catastrophically. At this point, the only thing that will course-correct these hotels is a widely distributed COVID vaccine.

Source: STR 2020 © CoStar Realty Information, Inc.

However, there is hope! The MMGY travel intent survey for July showed 64% of respondents planned to take a leisure trip in the next six months and most expected to drive. More surprising is that 33% of respondents expect to take a business trip in the next six months. The consumers’ return to travel will likely behave like a product adoption cycle (with early adopters and laggards) with an overlay of personal risk assessment. In other words, younger, healthier, and wealthier consumers are more likely to take advantage of travel deals and get moving first.

BOTTOM LINE

The virus is the boss, and its contagion and mortality rates will continue to drive consumer behavior related to hotel demand. A viable therapeutic(s) and/or treatment protocol(s) that brings the COVID-19 mortality rate closer to the traditional flu will further accelerate transient and small group leisure demand. With luck, a limited medical solution may get a higher percentage of business travel and small corporate groups off the sidelines. Large group demand, as noted, will require a vaccine.

Hotel Supply: Arrested Development

U.S. hotel rooms in construction peaked at an all-time high of 214k in June, beating the previous record from 2007. There are another 450k rooms in the planning and final planning stages at this time. Given the dismal demand environment, it is unlikely projects without firm financing in place will come to completion anytime soon, if ever.

Walking into a loan committee today with a hospitality project would be about as well-received as offering a handshake after a heavy coughing spell. Lenders are in the process of writing down hotel loans on their balance sheets and have no appetite for a larger hospitality allocation. Without debt capital, it is difficult, if not impossible, to make the math work on a hotel project.

BOTTOM LINE

Projects under construction will likely be delivered. New hotel development, with few exceptions, is not happening for a long time. Current hotel stock will deteriorate in quality as renovations are postponed due to a lack of funds. This will create a post-virus demand advantage for hotel owners who have the money to keep up with CapEx spending and needed renovations.